Kikoff raises $ 30 million for its hybrid consumer credit and financial education service – TechCrunch

Kikoff, a personal finance platform aimed at helping consumers build credit, today announced it has raised $ 30 million in a Series B cycle.

The capital is in addition to the $ 12.5 million the startup has raised through previously unannounced start-up and Series A rounds, both of which were led by Lightspeed Venture partners.

Portage Ventures led Kickoff’s Series B, which included participation from Lightspeed, GGV, Coatue and Core Innovation Capital. Previous backers for the company include NBA star Steph Curry, Wex CEO Melissa Smith and Teresa Ressel, former chief financial officer of the US Department of the Treasury.

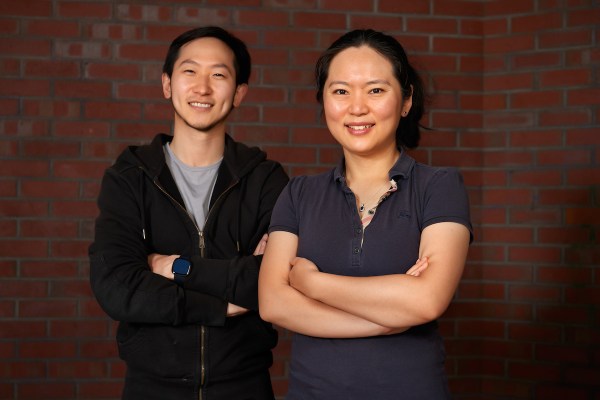

CEO Cynthia Chen and CTO Christophe Chong co-founded the San Francisco-based company in late 2019 with the goal of helping consumers with no credit history build one, and helping those with a bad credit history continue to build credit. The couple came from “low to moderate income” families, Chen said, and said they were keen to help others from similar economic backgrounds. Chen grew up in Beijing before coming to the United States to study on a scholarship and says she was struck by the experience of her parents having to borrow money from family and friends to buy one. television.

While the company declined to reveal specific revenue figures, Chen said Kikoff had “hundreds of thousands†of customers after being out of beta for six months.

Kikoff’s product, the “Kikoff Credit Accountâ€, is the first in a series of planned offers all aimed at improving the financial health of consumers.

“There are a lot of Americans who don’t come from well-off families and have tons of student loan debt,†Chen said. “For them and for so many others, we wanted to create a better way to create good credit than the existing offers in the market.” While anyone can use his platform, Chen says the vast majority of his clients are Millennials and GenZers because they need a way to build credit the most.

Image credits: Kikoff

With Kikoff, the duo aim to give people not only a way to build up a credit history, but also a way to increase consumers’ financial literacy. Rather than providing a debit or credit card that can be used anywhere, Kikoff limits the use of its line of credit to an online store it has set up. Users can buy things like eBooks covering a variety of finance related topics, such as planning and budgeting, or profit from bitcoin trading. He also offers a selection of courses he has purchased resell rights for, covering topics like personal finance education, or how to start an ecommerce store or even how to learn Python programming skills.

“When a consumer buys something from our store, [that] This article will help that person improve their financial habits or make money by making smarter investments, or starting a small business or learning skills, â€Chen told TechCrunch.

The company also does not charge interest on its line of credit or fees for financing.

“There is no cost to borrow money,†she said. Instead, Kikoff earns revenue by taking the margin between the wholesale price of the items he sells in his store and the retail price customers pay.

To enroll, customers first apply for a $ 500 revolving line of credit that can be used for purchases at Kikoff’s online store. The company claims that in a matter of months, its customers “can become eligible for better interest rates, competitive credit cards and mortgages,†among other things within a relatively short period of around 45 days.

Kikoff intentionally worked to help his clients create credit in a way that Chen describes as “a very financially responsible way.”

“That’s why they can only use the product in our exclusive online store, and we have a number of affordable items in the store that they can purchase,†she told TechCrunch. “So it’s relatively easy for them not to overspend or make an impulse purchase that they can’t really afford to pay later.

Lightspeed partner Ansaf Kareem said he could understand Chen and Chong’s experiences of having to create and build credit for the first time, “especially as immigrants and first-generation Americans.”

“A credit score holds the keys to your financial future, but so many Americans struggle to create and build credit, â€he said. “Adjacent products may allow you to check your credit score, but do not provide tools or advice to improve it without charging a fee or requiring a large cash commitment,†he added. “Kikoff has created a product that delivers real value through a simple, no-cost structure to initiate and create credit. And they’re just getting started.

Kikoff’s management team certainly have an impressive fintech background. Chen previously served as Figure’s Chief Risk Officer and held senior positions at Capital One and OnDeck. Chong was the former head of growth at Lime and led the growth teams at Facebook and Square. Andrew Brix, Chief Product Officer of Kikoff, was Credit Karma’s No.15 employee and served as Director of Product Management. He was also a senior product manager at E-Trade. Patrick Glover, Head of Marketing, worked at Plaid and Square and Vinni Bala, Head of Operations, is the former Marketing Director and Credit Director at Deserve.

Other companies with similar goals that have recently raised venture capital funds include Tomo Credit and Welcome Tech, among others.